Assessment |

Biopsychology |

Comparative |

Cognitive |

Developmental |

Language |

Individual differences |

Personality |

Philosophy |

Social |

Methods |

Statistics |

Clinical |

Educational |

Industrial |

Professional items |

World psychology |

Statistics: Scientific method · Research methods · Experimental design · Undergraduate statistics courses · Statistical tests · Game theory · Decision theory

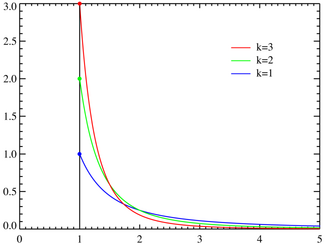

Probability density function Pareto probability density functions for various α (labeled "k") with xm = 1. The horizontal axis is the x parameter. As α → ∞ the distribution approaches δ(x − xm) where δ is the Dirac delta function. | |

Cumulative distribution function Pareto cumulative distribution functions for various α(labeled "k") with xm = 1. The horizontal axis is the x parameter. | |

| Parameters | scale (real) shape (real) |

| Support | |

| cdf | |

| Mean | |

| Median | |

| Mode | |

| Variance | |

| Skewness | |

| Kurtosis | |

| Entropy | |

| mgf | |

| Char. func. | |

The Pareto distribution, named after the Italian economist Vilfredo Pareto, is a power law probability distribution that coincides with social, scientific, and many other types of observable phenomena. Outside the field of economics it is sometimes referred to as the Bradford distribution.

Definition[]

If X is a random variable with a Pareto (Type I) distribution,[1] then the probability that X is greater than some number x is given by

where xm is the (necessarily positive) minimum possible value of X, and α is a positive parameter. The family of Pareto distributions is parameterized by two quantities, xm and α. When this distribution is used to model the distribution of wealth, then the parameter α is called the Pareto index.

Properties[]

Cumulative distribution function[]

From the definition, the cumulative distribution function of a Pareto random variable with parameters α and xm is

Graphical representation[]

When plotted on linear axes, the distribution assumes the familiar J-shaped curve which approaches each of the orthogonal axes asymptotically. All segments of the curve are self-similar (subject to appropriate scaling factors).

When plotted on logarithmic scales (both axes logarithmic), the distribution is represented by a straight line.

Probability density function[]

It follows (by differentiation) that the probability density function is

Moments and characteristic function[]

- The expected value of a random variable following a Pareto distribution with α > 1 is

-

- (if α ≤ 1, the expected value does not exist).

- The variance is

-

- (If α ≤ 2, the variance does not exist.)

- The raw moments are

-

- but the nth moment exists only for n < α.

- The moment generating function is only defined for non-positive values t ≤ 0 as

- The characteristic function is given by

-

- where Γ(a, x) is the incomplete gamma function.

Degenerate case[]

The Dirac delta function is a limiting case of the Pareto density:

Conditional distributions[]

The conditional probability distribution of a Pareto-distributed random variable, given the event that it is greater than or equal to a particular number x1 exceeding xm, is a Pareto distribution with the same Pareto index α but with minimum x1 instead of xm.

A characterization theorem[]

Suppose Xi, i = 1, 2, 3, ... are independent identically distributed random variables whose probability distribution is supported on the interval [xm, ∞) for some xm > 0. Suppose that for all n, the two random variables min{ X1, ..., Xn } and (X1 + ... + Xn)/min{ X1, ..., Xn } are independent. Then the common distribution is a Pareto distribution.

Applications[]

Pareto originally used this distribution to describe the allocation of wealth among individuals since it seemed to show rather well the way that a larger portion of the wealth of any society is owned by a smaller percentage of the people in that society. He also used it to describe distribution of income.[2] This idea is sometimes expressed more simply as the Pareto principle or the "80-20 rule" which says that 20% of the population controls 80% of the wealth.[3] However, the 80-20 rule corresponds to a particular value of α, and in fact, Pareto's data on British income taxes in his Cours d'économie politique indicates that about 30% of the population had about 70% of the income. The probability density function (PDF) graph at the beginning of this article shows that the "probability" or fraction of the population that owns a small amount of wealth per person is rather high, and then decreases steadily as wealth increases. This distribution is not limited to describing wealth or income, but to many situations in which an equilibrium is found in the distribution of the "small" to the "large". The following examples are sometimes seen as approximately Pareto-distributed:

- The sizes of human settlements (few cities, many hamlets/villages)[4]

- The standardized price returns on individual stocks [4]

Fitted cumulative Pareto distribution to maximum one-day rainfalls using CumFreq [5]

- Numbers of species per genus (There is subjectivity involved: The tendency to divide a genus into two or more increases with the number of species in it)[citation needed]

- Severity of large casualty losses for certain lines of business such as general liability, commercial auto, and workers compensation.[6][7]

Relation to other distributions[]

Relation to the exponential distribution[]

The Pareto distribution is related to the exponential distribution as follows. If X is Pareto-distributed with minimum xm and index α, then

is exponentially distributed with intensity (rate parameter) α. Equivalently, if Y is exponentially distributed with intensity α, then

is Pareto-distributed with minimum xm and index α.

This can be shown using the standard change of variable techniques:

The last expression is the cumulative distribution function of an exponential distribution with intensity α.

Relation to the log-normal distribution[]

Note that the Pareto distribution and log-normal distribution are alternative distributions for describing the same types of quantities. One of the connections between the two is that they are both the distributions of the exponential of random variables distributed according to other common distributions, respectively the exponential distribution and normal distribution. (Both of these latter two distributions are "basic" in the sense that the logarithms of their density functions are linear and quadratic, respectively, functions of the observed values.)[citation needed]

Relation to the generalized Pareto distribution[]

The Pareto distribution is a special case of the generalized Pareto distribution, which is a family of distributions of similar form, but containing an extra parameter in such a way that the support of the distribution is either bounded below (at a variable point), or bounded both above and below (where both are variable), with the Lomax distribution as a special case. This family also contains both the unshifted and shifted exponential distributions.

Relation to Zipf's law[]

Pareto distributions are continuous probability distributions. Zipf's law, also sometimes called the zeta distribution, may be thought of as a discrete counterpart of the Pareto distribution.

Relation to the "Pareto principle"[]

The "80-20 law", according to which 20% of all people receive 80% of all income, and 20% of the most affluent 20% receive 80% of that 80%, and so on, holds precisely when the Pareto index is α = log45, approximately 1.161. Moreover, the following have been shown[8] to be mathematically equivalent:

- Income is distributed according to a Pareto distribution with index α > 1.

- There is some number 0 ≤ p ≤ 1/2 such that 100p% of all people receive 100(1 − p)% of all income, and similarly for every real (not necessarily integer) n > 0, 100pn% of all people receive 100(1 − p)n% of all income.

This does not apply only to income, but also to wealth, or to anything else that can be modeled by this distribution.

This excludes Pareto distributions in which 0 < α ≤ 1, which, as noted above, have infinite expected value, and so cannot reasonably model income distribution.

Pareto, Lorenz, and Gini[]

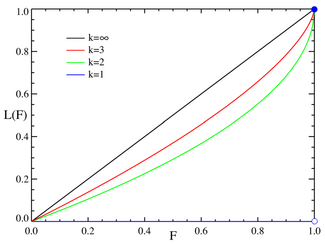

Lorenz curves for a number of Pareto distributions. The case α = ∞ corresponds to perfectly equal distribution (G = 0) and the α = 1 line corresponds to complete inequality (G = 1)

The Lorenz curve is often used to characterize income and wealth distributions. For any distribution, the Lorenz curve L(F) is written in terms of the PDF ƒ or the CDF F as

where x(F) is the inverse of the CDF. For the Pareto distribution,

and the Lorenz curve is calculated to be

where α must be greater than or equal to unity, since the denominator in the expression for L(F) is just the mean value of x. Examples of the Lorenz curve for a number of Pareto distributions are shown in the graph on the right.

The Gini coefficient is a measure of the deviation of the Lorenz curve from the equidistribution line which is a line connecting [0, 0] and [1, 1], which is shown in black (α = ∞) in the Lorenz plot on the right. Specifically, the Gini coefficient is twice the area between the Lorenz curve and the equidistribution line. The Gini coefficient for the Pareto distribution is then calculated to be

- (?? - Talk:Pareto distribution#Gini coeff)

(see Aaberge 2005).

Parameter estimation[]

The likelihood function for the Pareto distribution parameters α and xm, given a sample x = (x1, x2, ..., xn), is

Therefore, the logarithmic likelihood function is

It can be seen that is monotonically increasing with , that is, the greater the value of , the greater the value of the likelihood function. Hence, since , we conclude that

To find the estimator for α, we compute the corresponding partial derivative and determine where it is zero:

Thus the maximum likelihood estimator for α is:

The expected statistical error is:

Graphical representation[]

The characteristic curved 'long tail' distribution when plotted on a linear scale, masks the underlying simplicity of the function when plotted on a log-log graph, which then takes the form of a straight line with negative gradient.[citation needed]

Generating a random sample from Pareto distribution[]

Random samples can be generated using inverse transform sampling. Given a random variate U drawn from the uniform distribution on the unit interval (0, 1], the variate T given by

is Pareto-distributed.[citation needed] If U is uniformly distributed on [0, 1), it can be exchanged for (1 - U).

Bounded Pareto distribution[]

- See also: Truncated distribution

| Probability density function | |

| Cumulative distribution function | |

| Parameters | location (real) location (real) |

| Support | |

| cdf | |

| Mean | |

| Median | |

| Mode | |

| Variance | |

| Skewness | |

| Kurtosis | |

| Entropy | |

| mgf | |

| Char. func. | |

The bounded Pareto distribution or truncated Pareto distribution has three parameters α, L and H. As in the standard Pareto distribution α determines the shape. L denotes the minimal value, and H denotes the maximal value. (The Variance in the table on the right should be interpreted as 2nd Moment).

The probability density function is

where L ≤ x ≤ H, and α > 0.

Generating bounded Pareto random variables[]

If U is uniformly distributed on (0, 1), then

is bounded Pareto-distributed.[citation needed]

Symmetric Pareto distribution[]

The symmetric Pareto distribution can be defined by the probability density function:[10]

It has a similar shape to a Pareto distribution for while looking like an inverted Pareto distribution for [citation needed].

See also[]

- Cumulative frequency analysis

- Pareto analysis

- Pareto efficiency

- Pareto interpolation

- Pareto principle

- The Long Tail

- Traffic generation model

Notes[]

- ↑ See Arnold (1983).

- ↑ Pareto, Vilfredo, Cours d’Économie Politique: Nouvelle édition par G.-H. Bousquet et G. Busino, Librairie Droz, Geneva, 1964, pages 299–345.

- ↑ For a two-quantile population, where approximately 18% of the population owns 82% of the wealth, the Theil index takes the value 1.

- ↑ 4.0 4.1 William J. Reed et al., “The Double Pareto-Lognormal Distribution – A New Parametric Model for Size Distributions”, Communications in Statistics : Theory and Methods 33(8), 1733-1753, 2004 p 18 et seq.

- ↑ Cumfreq, a free computer program for cumulative frequency analysis.

- ↑ Kleiber and Kotz (2003): page 94.

- ↑ (1980). Survival probabilities based on Pareto claim distributions. ASTIN Bulletin 11: 61–71.

- ↑ (2010). Pareto's Law. Mathematical Intelligencer 32 (3): 38–43.

- ↑ M. E. J. Newman (2005). Power laws, Pareto distributions and Zipf's law. Contemporary Physics 46 (5): 323–351.

- ↑ Grabchak, M. & Samorodnitsky, D.. Do Financial Returns Have Finite or Infinite Variance? A Paradox and an Explanation.

References[]

- Barry C. Arnold (1983). Pareto Distributions, International Co-operative Publishing House.

- Christian Kleiber and Samuel Kotz (2003). Statistical Size Distributions in Economics and Actuarial Sciences, Wiley.

- M. O. Lorenz (1905). Methods of measuring the concentration of wealth. Publications of the American Statistical Association 9 (70): 209–219.

- Pareto V (1965) "La Courbe de la Repartition de la Richesse" (Originally published in 1896). In: Busino G, editor. Oevres Completes de Vilfredo Pareto. Geneva: Librairie Droz. pp. 1–5.

External links[]

- The Pareto, Zipf and other power laws / William J. Reed – PDF

- Gini's Nuclear Family / Rolf Aabergé. – In: International Conference to Honor Two Eminent Social Scientists, May, 2005 – PDF

- syntraf1.c is a C program to generate synthetic packet traffic with bounded Pareto burst size and exponential interburst time.

- "Self-Similarity in World Wide Web Traffic: Evidence and Possible Causes" /Mark E. Crovella and Azer Bestavros

- Eric W. Weisstein, Pareto distribution at MathWorld.

|

Probability distributions [[[:Template:Tnavbar-plain-nodiv]]] | |

|---|---|---|

| Univariate | Multivariate | |

| Discrete: | Bernoulli • binomial • Boltzmann • compound Poisson • degenerate • degree • Gauss-Kuzmin • geometric • hypergeometric • logarithmic • negative binomial • parabolic fractal • Poisson • Rademacher • Skellam • uniform • Yule-Simon • zeta • Zipf • Zipf-Mandelbrot | Ewens • multinomial |

| Continuous: | Beta • Beta prime • Cauchy • chi-square • Dirac delta function • Erlang • exponential • exponential power • F • fading • Fisher's z • Fisher-Tippett • Gamma • generalized extreme value • generalized hyperbolic • generalized inverse Gaussian • Hotelling's T-square • hyperbolic secant • hyper-exponential • hypoexponential • inverse chi-square • inverse gaussian • inverse gamma • Kumaraswamy • Landau • Laplace • Lévy • Lévy skew alpha-stable • logistic • log-normal • Maxwell-Boltzmann • Maxwell speed • normal (Gaussian) • Pareto • Pearson • polar • raised cosine • Rayleigh • relativistic Breit-Wigner • Rice • Student's t • triangular • type-1 Gumbel • type-2 Gumbel • uniform • Voigt • von Mises • Weibull • Wigner semicircle | Dirichlet • Kent • matrix normal • multivariate normal • von Mises-Fisher • Wigner quasi • Wishart |

| Miscellaneous: | Cantor • conditional • exponential family • infinitely divisible • location-scale family • marginal • maximum entropy • phase-type • posterior • prior • quasi • sampling | |

Some common univariate probability distributions | |

|---|---|

| Continuous | |

| Discrete | |

| List of probability distributions | |

| This page uses Creative Commons Licensed content from Wikipedia (view authors). |

![{\displaystyle x_{\mathrm {m} }{\sqrt[{\alpha }]{2}}}](https://services.fandom.com/mathoid-facade/v1/media/math/render/svg/a0cad1fdefb8f6cb4f7a931680730b25113d5f15)

![{\displaystyle f_{X}(x)={\begin{cases}\alpha \,{\dfrac {x_{\mathrm {m} }^{\alpha }}{x^{\alpha +1}}}&{\text{for }}x>x_{\mathrm {m} },\\[12pt]0&{\text{for }}x<x_{\mathrm {m} }.\end{cases}}}](https://services.fandom.com/mathoid-facade/v1/media/math/render/svg/b3098afc8073ba1557dae49a396d6194d31cb68c)